- Case Study -

Streamlined Payroll for Weehawken Township: Meeting New Jersey's Chapter 78 Standards

Weehawken Township

Weehawken is a township in the northern part of Hudson County, in the U.S. state of New Jersey. It is located on the Hudson Waterfront and Hudson Palisades overlooking the Hudson River.

In 2011 the State of New Jersey implemented a health benefits reform law, called Chapter 78, requiring public sector employees to contribute a % of their paycheck to their health benefits. Many organizations participating in State-administered retirement systems and health benefits programs, like Weehawken Township, have had to resort to significant manual payroll efforts to comply with the state’s legislation. There was a growing need to automate this process in order to free up critical resources, and eliminate the risk of legal ramifications that could result from errors due to manual calculations and data entry.

Navigating Chapter 78 Compliance

Enhanced Paychex payroll functionality was delivered through the use of the Mindex Integration Platform to fulfill the requirements of the Chapter 78 health benefits deduction calculation.

Mindex Integration Platform Implementation

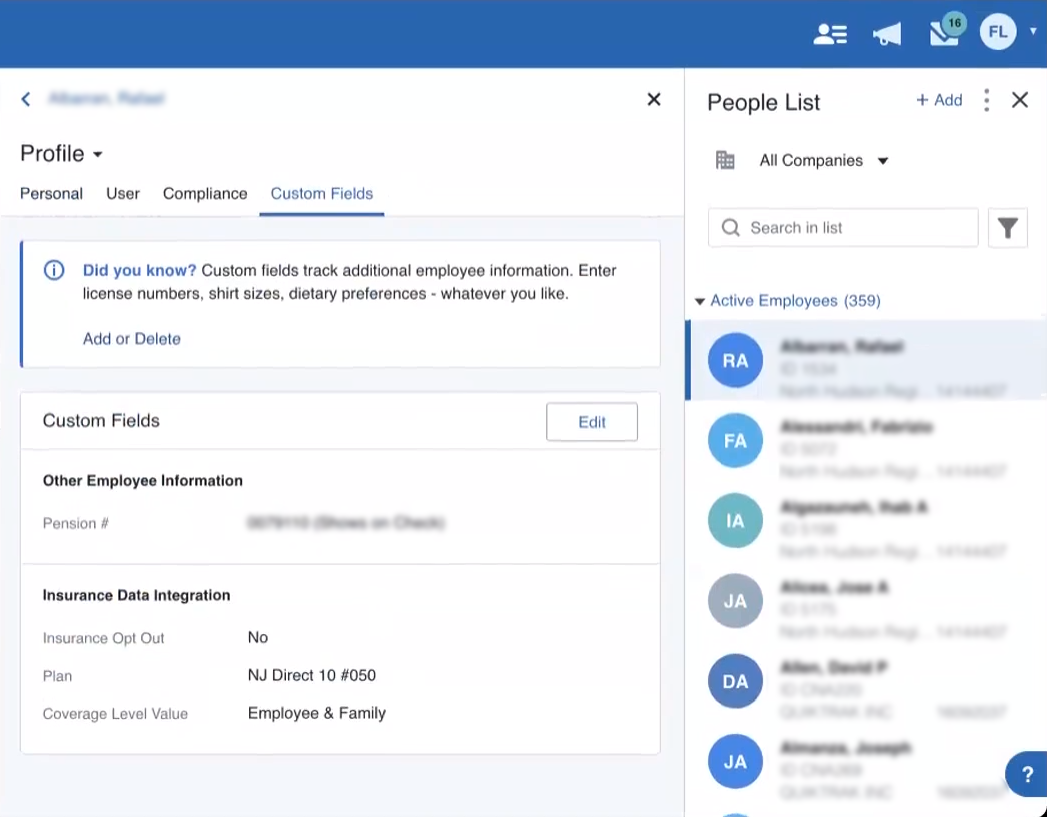

Using custom fields in Paychex Flex to store employee’s elected health plans and coverage levels, Paychex APIs to pull employee salaries, and custom tables to store health plan premiums and Chapter 78 contribution percentages, the Mindex platform performs logic that sets the appropriate deduction amount in each employee profile. The calculated deduction amount is then automatically applied during every payroll process.

To account for new employees or existing employee changes that would impact the calculation, such as a salary increase or change in coverage level from a qualifying event, the Mindex Integration Platform monitors the required data through Paychex APIs on a nightly basis. If a change is detected that requires an updated deduction calculation, the platform automatically uses the established logic to set an updated deduction amount in the employee profile to be used in the next payroll.

The implementation was seamless; Mindex was able to handle the integration with Paychex with very little required of me. The Mindex team handled everything, and they had it completed and ready to roll out at the beginning of our payroll process. We had plenty of time to confirm that the deductions were correct before processing. We no longer need to put any thought into ensuring the medical deduction is correct for our employees; Mindex is running behind the scenes, daily calculating the deduction for us!

Jessica Ventura

Director of Personnel for the Township of Weehawken

Benefits

Mindex automated the new payroll functionality using the Mindex Integration Platform, which is a “systems-Integration-as-a-service” built in the AWS Cloud. This advanced solution offers numerous benefits for seamless payroll processing:

Infinite Scalability

The Mindex Integration Platform ensures seamless processing scalability, effectively handling increasing transaction volumes.

No Installation or Maintenance Required

Weehawken Township does not need to install, support, or maintain any hardware or software in support of this solution.

Managed Support and Maintenance

Upon project completion, continuous monitoring, support, and maintenance of the solution is managed by Mindex, allowing the client to focus on increasing productivity and efficiency across business-critical activities that matter to them most.